Running a business in the UK involves navigating a complex financial landscape, from tracking income and expenses to complying with HMRC regulations. While hiring an accountant is crucial for maintaining financial health, relying solely on their services can leave gaps in your daily financial management. This is where a robust bookkeeping system, such as InnMaster, becomes invaluable. Here’s why you need a bookkeeping system in addition to an accountant, and how InnMaster can streamline your financial processes for UK businesses.

Enhanced Accuracy and Organisation

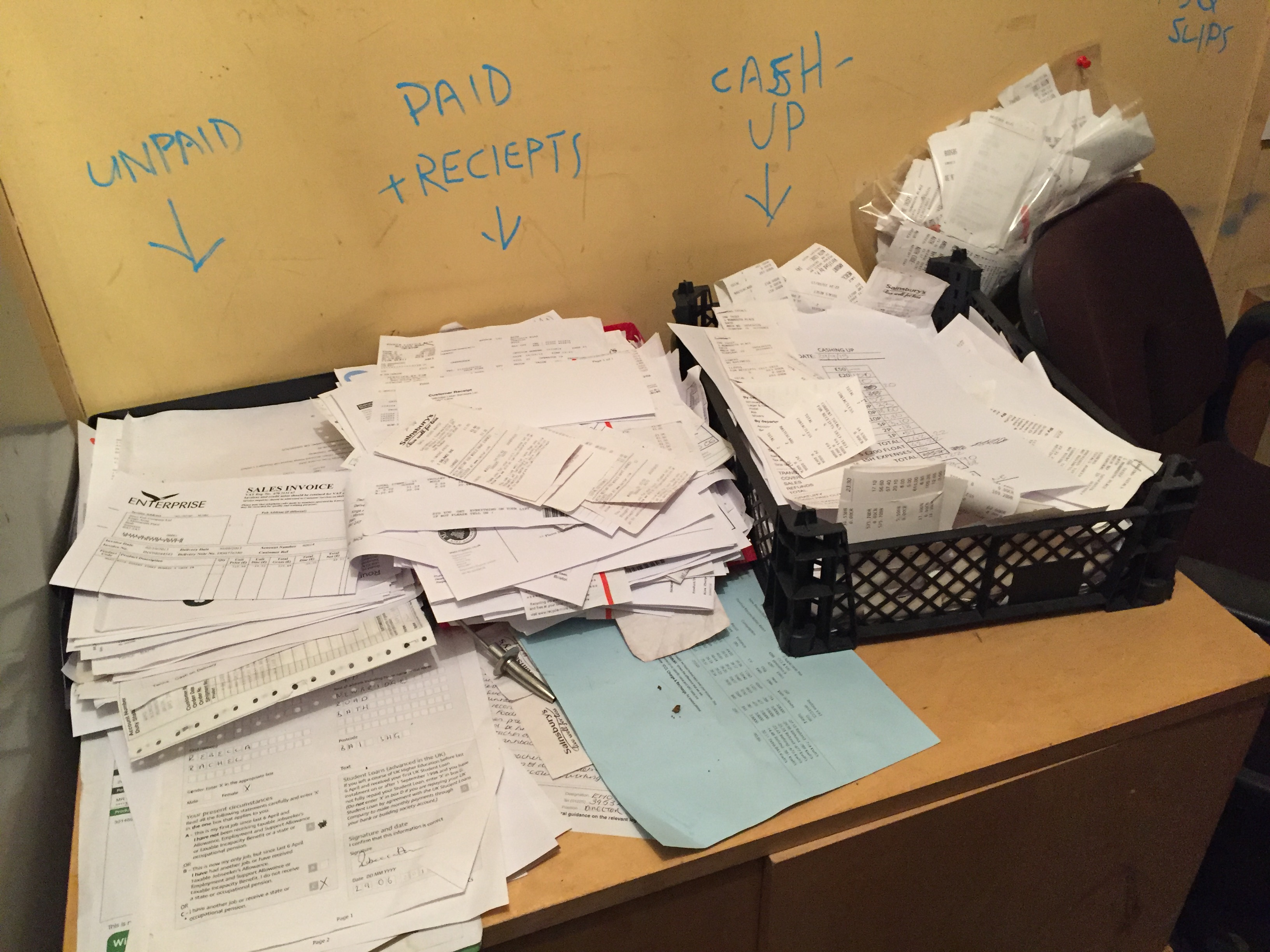

Accountants play a vital role in analysing your financial data, preparing reports, and ensuring compliance with tax regulations. However, they typically work with the data you provide them and take time to produce results. A bookkeeping system like InnMaster helps ensure that your business information is accurate and well-organised. With features designed to track every transaction, you minimise the risk of errors that could lead to costly mistakes.

InnMaster offers real-time financial tracking, allowing you to record income and expenses as they occur. This ensures your financial insight is immediate and up to date, providing a real-time picture of your business’s financial health. Such meticulous record-keeping supports your accountant in delivering more precise financial analysis, submission and advice.

Improved Cash Flow Management

Effective cash flow management is critical for the sustainability of any business. InnMaster provides tools to monitor your cash flow closely. By keeping track of incoming and outgoing payments, you can anticipate cash shortages and surpluses, allowing you to make informed decisions about spending and investments.

With features like invoicing, expense tracking, and automatic reminders for unpaid invoices, InnMaster helps you maintain a steady cash flow. This consistent monitoring allows your accountant to focus on strategic financial planning and advice rather than spending time reconciling transactions.

Streamlined VAT Preparation

VAT submission can be stressful, especially if your financial records are disorganised. A bookkeeping system like InnMaster simplifies VAT preparation by keeping all your financial data in one place. With detailed records of your income, expenses, and other financial transactions, you can easily collate the necessary information for VAT filing.

InnMaster’s comprehensive reporting capabilities ensure that your accountant has all the information needed for accurate VAT returns. This includes detailed breakdowns of VAT collected and paid, ensuring compliance with HMRC regulations and helping you avoid penalties. This seamless collaboration between your bookkeeping system and accountant results in a more efficient and stress-free VAT submission process.

Shadow Profit and Loss

InnMaster offers a shadow profit and loss feature, which provides an estimated financial performance based on your current data. This helps you monitor your profitability in real-time and make adjustments as needed. While not a formal profit and loss statement, it gives you a snapshot of your business's financial health between formal reports from your accountant.

Payroll Costing and Rota Management

InnMaster goes beyond basic bookkeeping by offering payroll costing functions and rota management. You can efficiently manage staff schedules and calculate payroll costs, ensuring you stay within budget. This feature is particularly useful for businesses in the hospitality industry, where labour costs can significantly impact profitability.

Liquor and Food Stock Management

Designed by professional stocktakers, InnMaster includes advanced liquor and food stock management features. These tools help you track inventory levels, manage orders, and reduce wastage. Accurate stock management ensures that you always have the right amount of stock on hand, preventing overstocking or running out of essential items.

But doesn't my Accountant do all this already...?

While an accountant is essential for providing expert financial advice and ensuring compliance with regulations, a bookkeeping system like InnMaster complements their work by enhancing the accuracy, organisation, and efficiency of your financial processes. By integrating InnMaster into your business, you ensure that your financial data is always up to date, your cash flow is well-managed, and your VAT preparation is streamlined.

But doesn't Sage or Xero provide this function?

InnMaster is tailored for hospitality businesses and the specifics of selling food and drink to customers, giving you an analysis of the GP% of individual products and dishes. Xero and Sage are built more to facilitate storeroom inventory and invoicing customers. Additionally, InnMaster’s payroll costing, rota management, and stock management features provide comprehensive all-in-one support for your day-to-day operations.

Ready to take your business to the next level? Visit www.Inn-Master.com to create a user account and start your 30-day free trial today. Discover how InnMaster can transform your financial management and help your business thrive. Don't miss out on the opportunity to optimise your bookkeeping processes and achieve financial success. Sign up now!